It's real estate really a safe investment? I mean the world has changed

dramatically. Technology is changing, is real-estate changing? Today here on

Limitless Wealth TV, me and Steven Michael Miller are going to break down

real estate and we're really going to get into the nuts and bolts and brass

tacks of whether or not it's a safe place for you to be or not.

Real estate, a safe investment? This is such a great question and I don't know

if you're asking the right guys here, right? Because if you ask your financial

planners or your tax advisers, you're going to get a lot of people up they're

going to say, "don't do real estate". But you're talking to guys here that have

done nearly a billion dollars worth of real estate. So we're a little bit biased

but what we're going to do is, we're going to share with you the information that

creates that bias for us, so you can understand, because up front, you got to

understand something. Does real estate have risk?

Yes, but here's the facts of life when it comes to money, this is the

birds-and-the-bees of money .If you want to become financially, you weren't

expecting that I was going to say. I wasn't expecting. The birds-and-the-bees of

financial life is that, don't pollinate your money? No we want to pollinate the money.

We want to multiply it like crazy. We do want to pollinate, yes, we want to fit man in

this. So that's German for multiply. So you got to understand that if you

don't take risks, you are guaranteed to fail. Yeah. Like if you got a great paying

job, I'm talking about you got a multiple six-figure job and you're an incredible

saver. You might be able to save enough money with taking very little to no risk.

Just putting money under the mattress, securities, bonds, you know, real basic

financial instruments. Yeah. I mean if you're learning how to live on half of

your income and you're saving the other half you might do okay. If you do that

for forty years. Yes and then when you retire, it's not going to be like a grand

retirement. But you know, what you're going to financially survive. Hands down yes

you are. Here's the reality, to get where you want to go, there's going to have to

take risk, but there's intelligent risk and then there's like Vegas risk. And so

what we want to do is, we want to talk about real estate and talk about what

it's real risks are. How you mitigate those risks, as a bonus to the video and

really help you understand why are people investing in real estate, anyway.

So the question is, is it safe to invest in real estate and and that safety

question, I don't want to overly blanket or stereotype anybody but

I'm married and I've been around a lot of women in my life. With that a mother

and have four daughters and cousins and you know friends and I think this idea

of safety and security is predominantly a you know a female.

I mean it's driven by females, a lot. Well I'll tell you

we've met enough couples that one of the two whether it's the man or the woman or

the however, there's at least one person in the relationship, don't beat me up

over this, okay? I'm not... There's going to be at least...I'm still worried

Steven I'm trying to save you a little bit here, okay? I'm not being sexist. No, I want to

address this though, because that nesting instinct, there is that desire, for having

safety. And they're not always saying, "oh who cares about financial security." We

got to make sure that we got things covered today, absolutely. And in any

relationships, there's always going to be at least one person. Thank you for saving me.

That place is safe. So safety and security is something that all people want. Is that

better? Something all people want. But the way that they get, but the way they

go about it, the way that they get it, is often really misguided and misunderstood.

So think about this for just a moment. Let's think about what the world thinks

as safe. Now the world says it's safe to buy your home and to pay it off as

quickly as you possibly can. Like just pay it off. It's also safe to put your

money in a 401k. Like those are what the world will tell you our safe investments.

Your own home, the 401k. Now let's look at history for just a moment .Will your 401k

ever truly be able to retire you well? No. Well your home, if you pay it off, does

your home pay you once you've got it paid off? No, no so at the end of a 30 or

40 year or 50 or working career, if all you have to show for it is a meager 401k

and a paid off home, then you're going to have to plunder them. Are you safe? No because

you have to pillage them. No, you know, here's the thing, you know what's going to

happen. And you were talking about risk. here, a second, but I'll go Kris you

know that it's riskier to put your money in your own home and in a 401k. That is

actually riskier, because at the end of those, at the end of the day, you know

exactly what it's going to produce for you which will be not enough. Yeah, so

it's interesting we know we need to take risk, but now we need to take calculated

risks. We need to take smart risk and I want to be clear. Steven said this, if

we're talking about real estate and just dropping a blanket over all of it, I do

not believe in most real estate is a good investment for the average consumer,

the average beginner investor and someone trying to get somewhere.

Commercial can be risky as anything. Skyscrapers cost too much to get into.

Well you could go dump of money, a bunch of money storage units and never get

them performing the way you want. There's a lot of risky real estate out there. And

so, I think the first thing to focus on, is that, it comes down to

strategy. Because in real estate, there's hyper risky strategies and then there's

near risk-free strategies. And Steven and I found what we believe to be a really

really good balance. There's only a handful of strategies that we really

recommend when it comes to lease options, partnering, buying in the nation's

hottest markets, leveraging a team and track record. There's things that we'll

do single family homes, purchase blow the median. There's even some commercial

deals. But they go through a very specific filter. So yes real estate can

be risky, but if you work with the team with the track record or you've got the

right strategy and philosophy, it can work out really really well for you.

There are predominantly four things that you want to be aware of that makes real

estate so attractive compared to other investments. Number one, taxes. Taxes have

the ability to erode our investments over time like crazy. They will rob us

the majority of our wealth. Now by the way, I believe in paying taxes, but I also

believe in using all the proper tax loopholes. So real estate gives you three

biggies. The first one is you get to write off all the interest. Number two,

you get to write off depreciation and the number three, you actually also get

to write off your business expenses. If you don't understand what those three

are, just super quick, when you pay a mortgage and you're collecting rent,

you're getting income but you have an expense. The interest, you get to write

off. Which ends up making a big difference on sometimes making money on

your real estate, but showing a loss. This is a good thing in the tax world. Making

money, real money, money. You keep and eat you're safe. But money that you're

actually not paying to taxes. Number two is depreciation to me...It's delicious, right?

You like that. I just want to hit depreciation real quick. Depreciation means, and by the way, they

just enhance the tax code that allows you to write off way more depreciation

one year front up some. I mean you can write off a ton of depreciation on that

property up front. This these are huge tax benefits. So depreciation is if I

have a $100,000 house, I get to write it off let's say over twenty seven years.

Every year I get to add three thousand extra dollars I ran off per property.

That's going to keep you from paying taxes and yet making money and then of

course can that business write-off so I think you get what that is. So that's the

first of the four bigs. And I don't know if you wanted to disclaim a real quick.

We are not tax professionals or tax advisers. We do not give tax advice, no legal

advice or any advice. This is no advice. It's just an information.

Awesome opinion. Alright, let's go on to the second reason. Why real estate is a

safe or what we would consider a safe investment. With real estate, you can

leverage and I know I get it a lot of people think that leverage is horrible

and risky and all that's crazy. Leverage is one of the safest things you

can do because you're putting a portion of your money in, to receive all of the

benefits, right? In other words, I can't go to the stock market and say, "hey let me

put... well I want to buy a hundred thousand dollars worth of stock,

but I'm only going to put $20,000 in. But I want the benefits as though I had the

whole hundred thousand dollars worth of stock. Yeah, stock market won't do that.

You guys, you can't do that anywhere. You can't but you can understand that

you can abuse that leverage. If you're putting leverage on a million dollar

house, yeah, prepare to lose lots of money. If you're putting leverage, you know, if

you don't have a right strategy, against strategy, it's going to bury you. But you let

that strategy on a single-family home price below the median $200,000 house

entry level house and some of the best and safest marks around the country, then

leverage, its going to make you a ton of money.

I mean think what leverage is, imagine I'm trying to move something impossible.

My big fireplace man, is right there, it wastes so much, it's impossible but if

I had a long enough lever, and if I was on the other end, I could move it with my

pinky. And tear this whole house down. So leverage with the right strategy is

incredibly powerful. Yeah, absolutely. So the third one here is, appreciation. Yeah,

your assets going to grow. Assets are going to grow. They're going to go. They're going to

go up, They're going to go down, but over time, they do what? They always go up. They

always go up. And by the way, they move in cycles. The cycles help you mitigate the

risks that you can understand timing on real estate when to buy, when to sell. By

the way, just a little hint here, when everyone is selling, it's a really good

time to - buy. And when everyone is buying, it's an excellent time to be - selling. Alright

so understand that as a sophisticated investor, you're always

going to be moving contrary to the populist. Counter-cyclically. Boom!

So appreciation, we don't count on it but you need to account for it it is going to

happen and the longer commitment and strategy you have into real estate, it's

going to actually be a big part of your winnings. But only a part depending on

strategy. And then the fourth one that I want to

talk about here, is that in most investing, it's highly speculative. I'm

going to put my money here and I hope it gets into something, right? Every three

out of four years, the market is up in the stock market. So my 401k, I'm going to be

up every you know three out of every four years. But every fourth year, guess

what? I'm going to take a dive. Every five to eight years there's a really big

correction it takes two or three years to come back from that. And so

financially, you understand that most things that you invest in, you put your

money in and you're speculating over time that you're going to get your money

back. But in real estate, while we are maybe speculated that the market will go

up even though it has like a three thousand near the track record on doing

that, the benefit that we get is real estate gives us something along the way.

It's real property, that can be rented, that produces income. Income producing

property, I mean, are there income producing stocks? No.Other income

producing 401k? No. Income producing IRA? No. Most investments are not income

producing. So real estate not only uses this incredible benefit of leverage, but

you're also getting this income component. By the way, the income

component alone, with the right strategy, can make this incredibly awesome.

So what about the speculation here for just a moment, Because I think this is

important first of all. If you're going to do real estate, do the type that is not

speculative in nature. This is what we really focus on is, doing that real

estate that is safer that has less risk, that is not speculative. But I want to

speak to this speculation for a moment, because speculation is what drives and

oftentimes what kills economies. Yeah. Okay, so let's let's just talk about for

a second. In the real estate markets and even in speculation within real estate.

You've got what happens is, when the markets go down, those that know, those

that are in the know, the experts will jump in. Like, the small percentage of

people that know what they're doing, what's up in, when the markets crash

Kris what do we do? Where we, with those markets that crash the hardest. We're

buying as much real estate and we jumped in. We bought as much as we possibly

could. My homes in Phoenix in Vegas for under a hundred thousand dollars that

were selling for two, three hundred thousand. We were a first mover. Now as a

first mover, people are speculative. People were speculative of what we were

doing. Okay? they were weary about it. They were leery, they were like, hmm

this seems strange. So they held off because of their speculation.

Okay they held off for a while, and then the market grew. They still held off for

a while, then the market grew more, they said, "I still don't know if this is safe

enough." They held off, had off until the market had turned almost around, then

those speculators, those that were the most speculative in the beginning, a

most skeptical in the beginning, right? Decided, finally okay, maybe I'll

jump in now. Oh it's amazing and hoping that it was going to continue to

increase and rise. Dude it's so amazing. The skeptical consumer is the opposite

of the sophisticated investor. So by the way, once once the skeptic gets

involved, you better be running for the hills because there's a reason why

they're skeptical. They keep getting spanked in life. You're about to get

spanked again, but by the way whether the skeptic says, "there's no way I'm going to do

that, guess what the sophisticated investors

are doing? I'm in. There pouncing on all over it. So point is, this is skepticism

and speculation oftentimes go hand in hand. Now, I do want to I do want to say

something. In real estate and in business and in financial life, you got to be

pessimistic. Yeah I wouldn't be really clear. I'm not, I don't mean negative. I

don't mean I don't mean skeptical in a negative way. What I mean

is you can't afford to be optimistic when it comes to money. When it comes to

real estate, you need to be able to look at it and say how am I going to lose money.

This is one of the best questions that you can ask. You should write it down. I

got this from my billionaire mentor. He said, "how am I going to lose money?" Anytime I

look at investment. I'm asking how am I going to lose. Show me how I'm going to lose

money or show me how we can't lose money. Because now, we're actually looking at it

like a business. Because by the way, can you lose money in real estate? Yes. We're

not here to tell you to be optimistic and then it's all roses. We're staying

with the right strategy and understanding it, you can win long-term.

Because we've been winning and thousands of our clients, have been winning with us

along our side. So today friends, we talked about, is real estate a safe

investment for us? When we reign. Now I've got 20 different asset classes that I

invest in and real estate is ranked amongst the safest, but it's asymmetrical

and risk. That means that, it has a very high upside as very low downside with

the right strategy. Are you hearing that theme today? Yes, we're talking about tax

benefits, yes we're talking about leverage, yes we're talking about growth

and appreciation. Yes we're talking about income producing investments. Those are

all things that make real estate unique, standout and absolutely incredible. But

it's all contingent on what strategy. So, our advice is if you're

liking this video, subscribe, check out some of the other things that we talk

about here. And when you feel like you're ready to figure out how Kris, "what do

you mean real estate is asymmetrical? How do we actually jump in and get in on

real estate that has some of the highest gains but very low risk?" Head over to our

website. Check out the different options that wheel out there, because Steven and

I, we have our YouTube friends that come and partner with us and invest with us

all the time. Some are very wealthy and they partner

directly with Steven and I. And we'll build a portfolio together, others, you

just borrow our team and our team will do it for you. Or if you're starting with

no money, we'll even show you how you can get started for under $1,000 to start

crushing in real estate. You got all those options on the website. So are we

big believers in real estate? Yes as long as you've got the right - strategy. Thank

you so much for watching this video. Listen, if you haven't already, go ahead

and subscribe. Hit that button in the corner, so that you and I, we can become

even better friends. And you know what, if you want to come join Steven and I at

one of our live events or you want to learn about the different ways that we

can be playing in real estate together, check out the link, make sure you're

familiar. We're always updating it and in the least, download my book for free. If

you want to learn more about how safe real estate can be and how to mitigate

the risks that are there, then my book that I give you both an e-book and

audiobook format can be a super useful tool, for showing you how to crush it.

For more infomation >> Ep4 It's on you and I | BTS: Burn the Stage - Duration: 26:25.

For more infomation >> Ep4 It's on you and I | BTS: Burn the Stage - Duration: 26:25.  For more infomation >> リメイキング イレリア - 制作の舞台裏 - Duration: 8:28.

For more infomation >> リメイキング イレリア - 制作の舞台裏 - Duration: 8:28.

For more infomation >> WORLD CUP MODE IN FIFA 18 CONFIRMED! 😱 (FIFA 18 FIFA Millionaire) #8 - Duration: 10:44.

For more infomation >> WORLD CUP MODE IN FIFA 18 CONFIRMED! 😱 (FIFA 18 FIFA Millionaire) #8 - Duration: 10:44.  For more infomation >> Por que o plástico demora tanto pra se decompor? | Minuto da Terra - Duration: 2:32.

For more infomation >> Por que o plástico demora tanto pra se decompor? | Minuto da Terra - Duration: 2:32.  For more infomation >> April 11 - PUBG Best Moments of the Week #6 Shroud, TSM_Viss, MarcoOPz, Chad, Just9n - Duration: 11:01.

For more infomation >> April 11 - PUBG Best Moments of the Week #6 Shroud, TSM_Viss, MarcoOPz, Chad, Just9n - Duration: 11:01.

For more infomation >> Mercedes-Benz V-Klasse V 220 d Dubbel Cabine L - Duration: 0:57.

For more infomation >> Mercedes-Benz V-Klasse V 220 d Dubbel Cabine L - Duration: 0:57.  For more infomation >> Mercedes-Benz V-Klasse V 220 CDI Dubbel Cabine L | Regensensor | Parkeerassist - Duration: 0:43.

For more infomation >> Mercedes-Benz V-Klasse V 220 CDI Dubbel Cabine L | Regensensor | Parkeerassist - Duration: 0:43.

For more infomation >> Recriando Irelia - Bastidores | League of Legends - Duration: 8:28.

For more infomation >> Recriando Irelia - Bastidores | League of Legends - Duration: 8:28.

For more infomation >> Mercedes-Benz Vito 114 CDI DC L V-klasse spiegels | Lichtmetalen velgen Antraciet | - Duration: 0:58.

For more infomation >> Mercedes-Benz Vito 114 CDI DC L V-klasse spiegels | Lichtmetalen velgen Antraciet | - Duration: 0:58.

For more infomation >> Mercedes-Benz B-Klasse B 180 Urban | Ambition | Bagageruimtepakket - Duration: 0:57.

For more infomation >> Mercedes-Benz B-Klasse B 180 Urban | Ambition | Bagageruimtepakket - Duration: 0:57.  For more infomation >> Mercedes-Benz B-Klasse B 180 Automaat Line Style | Ambition - Duration: 0:42.

For more infomation >> Mercedes-Benz B-Klasse B 180 Automaat Line Style | Ambition - Duration: 0:42.  For more infomation >> Mercedes-Benz B-Klasse B 180 Business Solution AMG | Camera | Navi | Keyless-Go - Duration: 0:57.

For more infomation >> Mercedes-Benz B-Klasse B 180 Business Solution AMG | Camera | Navi | Keyless-Go - Duration: 0:57.  For more infomation >> Mercedes-Benz B-Klasse B 180 Automaat Family Edition - Duration: 1:02.

For more infomation >> Mercedes-Benz B-Klasse B 180 Automaat Family Edition - Duration: 1:02.  For more infomation >> Mercedes-Benz B-Klasse B 180 Business Solution - Duration: 0:42.

For more infomation >> Mercedes-Benz B-Klasse B 180 Business Solution - Duration: 0:42.  For more infomation >> Mercedes-Benz B-Klasse B 180 AMG Line | Ambition - Duration: 0:58.

For more infomation >> Mercedes-Benz B-Klasse B 180 AMG Line | Ambition - Duration: 0:58.

For more infomation >> Mercedes-Benz B-Klasse B 180 d Automaat Business Solution - Duration: 0:58.

For more infomation >> Mercedes-Benz B-Klasse B 180 d Automaat Business Solution - Duration: 0:58.  For more infomation >> Mercedes-Benz B-Klasse B 180 Family Edition Automaat | Urban | Navi | KEYLESS-GO - Duration: 0:54.

For more infomation >> Mercedes-Benz B-Klasse B 180 Family Edition Automaat | Urban | Navi | KEYLESS-GO - Duration: 0:54.  For more infomation >> Mercedes-Benz B-Klasse B 180 BE PRESTIGE 7G-DCT - Duration: 1:01.

For more infomation >> Mercedes-Benz B-Klasse B 180 BE PRESTIGE 7G-DCT - Duration: 1:01.  For more infomation >> Mercedes-Benz B-Klasse B 200 Automaat AMG-Exclusiefpakket | LED | Trekhaak | Navi - Duration: 0:43.

For more infomation >> Mercedes-Benz B-Klasse B 200 Automaat AMG-Exclusiefpakket | LED | Trekhaak | Navi - Duration: 0:43.  For more infomation >> Mercedes-Benz B-Klasse B180 Automaat Line Style | Ambition - Duration: 0:42.

For more infomation >> Mercedes-Benz B-Klasse B180 Automaat Line Style | Ambition - Duration: 0:42.  For more infomation >> Mercedes-Benz B-Klasse B160 Urban Line | Agility Select | Keyless-Go | Navi | Airco - Duration: 0:54.

For more infomation >> Mercedes-Benz B-Klasse B160 Urban Line | Agility Select | Keyless-Go | Navi | Airco - Duration: 0:54.  For more infomation >> Mercedes-Benz B-Klasse B 180 Automaat AMG Line | Ambition - Duration: 0:54.

For more infomation >> Mercedes-Benz B-Klasse B 180 Automaat AMG Line | Ambition - Duration: 0:54.  For more infomation >> Vlog - POOP SQUAD 2 al cinema! - Duration: 6:38.

For more infomation >> Vlog - POOP SQUAD 2 al cinema! - Duration: 6:38.  For more infomation >> Opel Insignia Grand Sport 1.5 Turbo 165pk Automaat, Business Executive ** Full Options * - Duration: 1:00.

For more infomation >> Opel Insignia Grand Sport 1.5 Turbo 165pk Automaat, Business Executive ** Full Options * - Duration: 1:00.  For more infomation >> 黄圣依儿子被奶奶"宠成道明寺"惹争议富养和溺爱真的是一回事吗? - Duration: 9:34.

For more infomation >> 黄圣依儿子被奶奶"宠成道明寺"惹争议富养和溺爱真的是一回事吗? - Duration: 9:34.

For more infomation >> Opel KARL 1.0 75pk Innovation - NAVI - LM VELGEN - CRUISE CONTROL - Duration: 0:57.

For more infomation >> Opel KARL 1.0 75pk Innovation - NAVI - LM VELGEN - CRUISE CONTROL - Duration: 0:57.  For more infomation >> A Big Super Sticky Glue Pran...

For more infomation >> A Big Super Sticky Glue Pran...

For more infomation >> The Limited Edition Makeup Tag - Duration: 10:13.

For more infomation >> The Limited Edition Makeup Tag - Duration: 10:13.  For more infomation >> 12 Choses qu'il vaut mieux éviter pour ne pas avoir une apparence négligée - Duration: 6:06.

For more infomation >> 12 Choses qu'il vaut mieux éviter pour ne pas avoir une apparence négligée - Duration: 6:06.  For more infomation >> 🥋📈 Comment Ricardo Teixeira est devenu champion du monde de karaté ET entrepreneur (86/365) - Duration: 1:05:07.

For more infomation >> 🥋📈 Comment Ricardo Teixeira est devenu champion du monde de karaté ET entrepreneur (86/365) - Duration: 1:05:07.

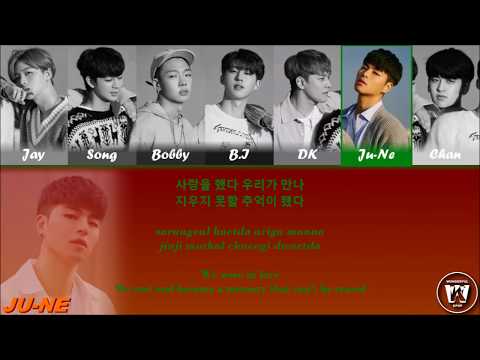

For more infomation >> iKON - 사랑을 했다 (LOVE SCENARIO) - Lyrics Video [HAN/ROM/ENG] (VOSTFR) - Duration: 3:31.

For more infomation >> iKON - 사랑을 했다 (LOVE SCENARIO) - Lyrics Video [HAN/ROM/ENG] (VOSTFR) - Duration: 3:31.  For more infomation >> Comment vendre ses photos🎥 en ligne? - Duration: 7:45.

For more infomation >> Comment vendre ses photos🎥 en ligne? - Duration: 7:45.  For more infomation >> Mayotte, hip-hop (R) évolution (2017) - Duration: 53:16.

For more infomation >> Mayotte, hip-hop (R) évolution (2017) - Duration: 53:16.  For more infomation >> MORNING ROUTINE FILLE || FR - Duration: 3:59.

For more infomation >> MORNING ROUTINE FILLE || FR - Duration: 3:59.  For more infomation >> Ces maladies sont toutes causées par les fours à micro-ondes, ce tueur silencieux - Duration: 5:23.

For more infomation >> Ces maladies sont toutes causées par les fours à micro-ondes, ce tueur silencieux - Duration: 5:23.  For more infomation >> C'est ce qui vous arrive si vous mangez 2 bananes tachetées par jour pendant un mois | Santé 24.7 - Duration: 9:16.

For more infomation >> C'est ce qui vous arrive si vous mangez 2 bananes tachetées par jour pendant un mois | Santé 24.7 - Duration: 9:16.  For more infomation >> Découvrez la nature et les causes de l'appendicite - Duration: 11:13.

For more infomation >> Découvrez la nature et les causes de l'appendicite - Duration: 11:13.  For more infomation >> 폭스바겐, 2009년형 파사트 TDI 스포츠 출시[Bike 24h] - Duration: 2:35.

For more infomation >> 폭스바겐, 2009년형 파사트 TDI 스포츠 출시[Bike 24h] - Duration: 2:35.  For more infomation >> PLAY TROU SEUL : CE CRABE ME TERRIFIE ! ON DESCEND DE PLUS EN PLUS BAS ! (Subnautica gameplay FR #8) - Duration: 31:08.

For more infomation >> PLAY TROU SEUL : CE CRABE ME TERRIFIE ! ON DESCEND DE PLUS EN PLUS BAS ! (Subnautica gameplay FR #8) - Duration: 31:08.  For more infomation >> Fiat Punto Evo 1.3 M-JET DYNAMIC - Airco - Duration: 0:59.

For more infomation >> Fiat Punto Evo 1.3 M-JET DYNAMIC - Airco - Duration: 0:59.  For more infomation >> Fiat Grande Punto 1.3 M-Jet Actual,5drs,Airco,NAP,incl.APK - Duration: 0:55.

For more infomation >> Fiat Grande Punto 1.3 M-Jet Actual,5drs,Airco,NAP,incl.APK - Duration: 0:55.  For more infomation >> BMW X5 3.0dA xDrive Blue Performance High Executive M-sport edition | Shadow Line | Xenon | Soft Clo - Duration: 0:54.

For more infomation >> BMW X5 3.0dA xDrive Blue Performance High Executive M-sport edition | Shadow Line | Xenon | Soft Clo - Duration: 0:54.  For more infomation >> Tomek wróci do "M jak miłość"? Andrzej Młynarczyk na planie z Małgorzatą Pieńkowską - Duration: 2:10.

For more infomation >> Tomek wróci do "M jak miłość"? Andrzej Młynarczyk na planie z Małgorzatą Pieńkowską - Duration: 2:10.  For more infomation >> Poród w "M jak miłość"! Ala urodzi syna. To dobije Pawła - Duration: 1:46.

For more infomation >> Poród w "M jak miłość"! Ala urodzi syna. To dobije Pawła - Duration: 1:46.  For more infomation >> Fiat Seicento 1.1 S Apk t/m februari 2019 - Duration: 0:53.

For more infomation >> Fiat Seicento 1.1 S Apk t/m februari 2019 - Duration: 0:53.

Không có nhận xét nào:

Đăng nhận xét